Unlocking Option: How Justin Ferguson is Reshaping Virginia Business Real Estate By way of Strategic Multifamily and Winery Investment decision

Introduction

Do you realize that multifamily investments accounted for approximately 40% of all commercial real estate property transactions within the U.S. recently? As need for diversified income streams and resilient property grows, investors are significantly turning to Virginia industrial real estate—a location rich in option, the two in city and rural landscapes.

A single title that consistently emerges In this particular space is Justin Ferguson, a seasoned pro in Virginia commercial real estate property, specializing in multifamily portfolios. Past real-estate, Ferguson retains a WSET Degree three certification in wine, supplying exceptional vineyard consulting expert services that blend company approach with oenological expertise. This text explores how Ferguson empowers company experts, builders, REITs, syndicators, and personal traders to mature and diversify their holdings—efficiently and profitably.

The Increase of Multifamily Investments in Virginia Business Housing

Why Virginia?

Virginia industrial housing is undergoing a change. With thriving metro parts like Northern Virginia, Richmond, and Norfolk—and picturesque rural zones perfect for vineyards—Virginia offers a dynamic financial commitment landscape. Key motorists contain:

A escalating populace fueled by tech and governing administration Employment.

Solid rental demand in city and suburban corridors.

Favorable tax and development procedures.

Multifamily Belongings: The Core of a sensible Portfolio

Justin Ferguson focuses on determining and optimizing multifamily assets—a cornerstone of Virginia industrial property. No matter whether advising REITs or guiding to start with-time investors, his technique facilities on:

Higher-generate possibilities in up-and-coming neighborhoods.

Strategic renovations to raise assets worth and rental profits.

Navigating zoning and local rules with negligible friction.

In accordance with Ferguson, “Multifamily Homes in Virginia present among the best chance-altered returns in the current market place.”

Ferguson’s Clients: Who He Aids And just how

Company Specialists In search of Passive Income

A lot of Ferguson’s purchasers are chaotic specialists who absence some time to manage housing. He streamlines the procedure by offering:

In depth industry Investigation.

Turnkey investment options.

Reliable assets management referrals.

Traders and Syndicators Scaling Competently

Efficiency is vital when scaling a Virginia professional real estate portfolio. Ferguson’s encounter aids syndicators and institutional buyers:

Source undervalued or off-industry discounts.

Composition financing To maximise returns.

Lessen operational prices while maximizing income circulation.

Builders and REITs Needing Area Experience

Navigating advancement approvals and current market traits can be challenging. Ferguson supplies:

In-depth current market investigate.

Feasibility scientific studies.

Coordination with architects, planners, and contractors.

The Vineyard Edge: Wine Financial investment in Virginia Commercial Property

A Licensed Sommelier’s Strategic Lens

Ferguson’s exceptional mixture of real estate and wine experience sets him apart. Being a WSET Stage three Qualified sommelier, he offers expense-grade vineyard consulting that appeals to substantial-Web-really worth men and women and agribusiness builders alike.

Why Vineyards in Virginia?

Virginia is definitely the fifth-largest wine-creating state inside the U.S., and its wine tourism sector is booming. Purchasing vineyards in the scope of Virginia business housing features:

Strong ROI via wine manufacturing and tourism.

Land appreciation in scenic, appealing spots.

Synergy with hospitality ventures like inns or tasting rooms.

Vineyard Investment decision Companies Incorporate:

Web-site collection dependant on terroir and zoning.

Grape varietal tips.

Business enterprise planning and market positioning.

“The wine industry here is not just about lifestyle—it’s about legacy and extended-phrase revenue,” Ferguson claims.

Vital Benefits of Working with Justin Ferguson

In this article’s why Ferguson stands out inside the Virginia industrial real-estate industry:

Dual Knowledge: Property acumen + wine business credentials.

Tailor-made Method: Each and every consumer receives a personalized expense roadmap.

Nearby Understanding: Decades of encounter navigating Virginia's special property dynamics.

Efficiency-Driven: Focused on maximizing ROI with minimal downtime.

Trader Insights: Strategies for fulfillment in Virginia Professional Real estate property

To prosper In this particular aggressive industry, Ferguson suggests:

Start with a clear investment goal—Hard cash move? Appreciation? Tax Added benefits?

Center on increasing areas with infrastructure enhancements and work development.

Partner with local industry experts like Ferguson to navigate pink tape and prevent typical pitfalls.

Swift Checklist for Multifamily and Winery Investment decision:

✅ Conduct a detailed sector Assessment.

✅ Appraise house problem and enhancement possible.

✅ Understand area tax incentives and zoning legislation.

✅ Align expenditure with extended-phrase lifestyle or economical aims.

Summary

The evolving landscape of Virginia industrial real estate is ripe with alternatives—from multifamily models in lively urban centers to boutique vineyards nestled during the Blue Ridge foothills. With Justin Ferguson’s twin-pronged knowledge, investors can tap into this prospective with self-confidence and clarity.

Whether you’re a company Qualified in search of passive earnings, a syndicator looking to scale, or simply a dreamer All set to take a position in wine country, Click Here Ferguson’s strategic solution makes certain your investment decision journey is as smooth to be a high-quality vintage.

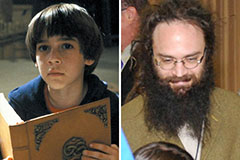

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!